This post looks at the results of selling a one-lot straddle on the S&P 500 Index (SPX), initiated at 38 days-to-expiration (DTE). This is the first post of five on 38 DTE straddles, and will only look at loss exits...the other four posts will explore different profit exits on top of the loss exits in this post. The results displayed in this post represent data from more than 800 individual trades entered by the backtester. Note, I am starting with 38 DTE because the rate of time decay (theta) of ATM options is theoretically greatest closer to expiration. This series will explore up to 80 DTE.

In the trade metrics tables, I have highlighted some of the metrics rows to indicate values that are in the upper half of the readings. One of the metrics to note is the average P&L per day in percentage terms (P&L % / Trade - Avg. P&L / Day). This is a measure of the P&L per day normalized to the maximum initial portfolio margin (initial PM) required for that trade run...it tells us the effectiveness of theta with respect to our margin requirement.

No IV Rank Filter

In this section we will look at the results of entering one trade for every monthly expiration regardless of the implied volatility (IV) rank of the SPX on the date of entry. Entering these trades at 38 DTE and utilizing our loss exits (described here) resulted in the equity curves below.

|

| (click to enlarge) |

The trade metrics for these different exits are shown in the table below. The win rates and P&L per day numbers are not great. This is due to the lack of profit based exits. These trades are either exited at expiration OR at the designated loss level.

|

| (click to enlarge) |

The table below shows the distribution of returns in five-number summary format. Hat-tip to tastytrade.

|

| (click to enlarge) |

Below are two images of scatter plots for selling 38 DTE ATM SPX straddles. The first image contains one scatter plot per strategy and shows P&L in percentage terms versus IV rank for the SPX. The IV rank was captured on the day each trade was initiated.

|

| (click to enlarge) |

The next image shows P&L in percentage terms versus initial ATM IV. This ATM IV was captured on the day each trade was initiated.

|

| (click to enlarge) |

IV Rank > 50% Filter

In this section we will look at the results of entering one trade for every monthly expiration only when the IV rank of the SPX is greater than 50% ( >50% ). Entering these trades at 38 DTE and utilizing our loss exits (described here) resulted in the equity curves below.

|

| (click to enlarge) |

The trade metrics for these different exits are shown in the table below. These trades have better win rates and better returns per day than the non-IV rank filtered trades

|

| (click to enlarge) |

The table below shows the distribution of returns in five-number summary format.

|

| (click to enlarge) |

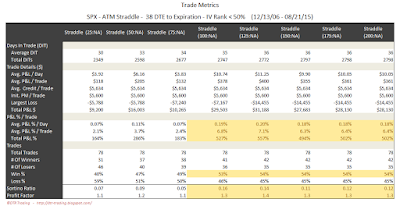

IV Rank < 50% Filter

In this section we will look at the results of entering one trade for every monthly expiration only when the IV rank of the SPX is less than 50% ( <50% ). Entering these trades at 38 DTE and utilizing our loss exits (described here) resulted in the equity curves below.

|

| (click to enlarge) |

The trade metrics for these different exits are shown in the table below. These trades have lower win rates and lower P&L per day numbers than the non-IV rank filtered trades shown in the first section.

|

| (click to enlarge) |

The table below shows the distribution of returns in five-number summary format.

|

| (click to enlarge) |

This post contains the foundational content needed for comparison with the four upcoming 38 DTE blog posts. As such, we didn't learn a lot about how the 38 DTE SPX short straddles perform other than the IV rank filter had a positive impact on trade results.

In the next post we will look at the backtest results of 38 DTE SPX short straddles using the same loss thresholds as above, but with profit taking occurring at 10% of the credit received.

You can follow my blog by email, RSS or Twitter. All options are free, and are available on the top of the right hand navigation column under the headings "Subscribe To RSS Feed", "Follow By Email", and "Twitter". I follow blogs by RSS using Feedly, but any RSS reader will work.

2 comments:

doesn't seem as good as the strangles

Agreed, on this first set of variations.

There's more to come, and there are a number of risk:reward/DTE combinations that have potential.

Post a Comment