For background on the setup for the backtests, as well as the nomenclature used in the charts and tables below, please see the introductory article for this series: Option Straddle Series - P&L Exits.

No IV Rank Filter

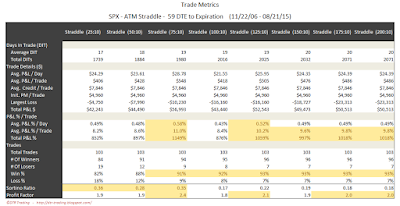

In this section we will look at the results of entering one trade for every monthly expiration regardless of the implied volatility rank (IVR) of the SPX on the date of entry. Entering these trades at 59 DTE and utilizing our loss exits and 10% credit exits (described here), resulted in the equity curves below. The returns are lower than some of the other variations, but the equity curves are reasonably smooth. Take a look at how these curves compare to the 52 DTE variations.

|

| (click to enlarge) |

The trade metrics for these different exits are shown in the table below. Six of the eight variations have win rates at 91% or greater. The (75:10) variation had the highest P&L % / day reading, highest overall P&L % value, and a win rate of 91%. The (125:10) variation stood out again, but this time it took second place.

|

| (click to enlarge) |

The table below shows the distribution of returns in five-number summary format. Hat-tip to tastytrade.

|

| (click to enlarge) |

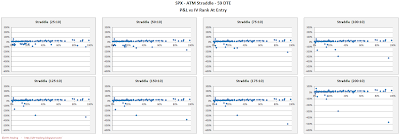

Below are three sets of scatter plots for selling 59 DTE ATM SPX straddles. The first image contains one scatter plot per strategy and shows P&L in percentage terms versus IVR for the SPX. The IVR was captured on the day each trade was initiated. There is a trend of increasing P&L with increasing IVR, but it is not very clear because the y-axis scale. This is the same y-axis scale used in the first post of this 59 DTE straddle series.

|

| (click to enlarge) |

The next image shows P&L in percentage terms versus initial ATM IV. This ATM IV was captured on the day each trade was initiated. Higher IV resulted in higher returns, but the majority of all trades occurred at lower IV, below 40. The bulk of the losing trades occurred at an IV below 20, but many winning trades occurred in this region as well.

|

| (click to enlarge) |

The third image shows P&L in percentage terms versus days-in-trade (DIT). When managing losses early (25%, 50%), the losses were fairly evenly distributed across DIT. As the loss management becomes less aggressive (125%, 150%, 175%, and 200%), the loss thresholds were were rarely hit. We still had losing trades, with losses realized at expiration...but these losses were mostly less than our threshold value at expiration.

|

| (click to enlarge) |

IV Rank > 50% Filter

In this section we will look at the results of entering one trade for every monthly expiration only when the IVR of the SPX is greater than 50% ( >50% ). Entering these trades at 59 DTE and utilizing our loss exits and 10% credit exits (described here) resulted in the equity curves below...not great, but better than the corresponding 52 DTE equity curves.

|

| (click to enlarge) |

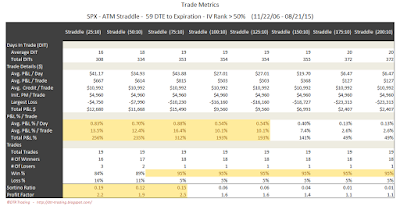

The trade metrics for these different exits are shown in the table below. There are significantly fewer trades that meet the >50% IVR criteria...only 19 out of 103. The win rate was fairly high (at 95%) for six of the eight variations, but total P&L % was in the range of only about 20% of the non-IVR filtered variations.

|

| (click to enlarge) |

The table below shows the distribution of returns in five-number summary format.

|

| (click to enlarge) |

IV Rank < 50% Filter

In this section we will look at the results of entering one trade for every monthly expiration only when the IVR of the SPX is less than 50% ( <50% ). Entering these trades at 59 DTE and utilizing our loss exits and 10% credit exits (described here) resulted in the equity curves below...which look better than the IVR > 50% equity curves.

|

| (click to enlarge) |

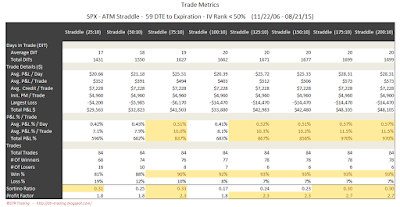

The trade metrics for these different exits are shown in the table below. Using the lower IVR filter resulted in trade metrics that were fairly similar to the non-IVR filtered strategy variations. The top performers were the (175:10) and (200:10) variations.

|

| (click to enlarge) |

The table below shows the distribution of returns in five-number summary format.

|

| (click to enlarge) |

In the next post we will look at the backtest results of 59 DTE ATM SPX short straddles using the same loss thresholds as above, but with profit taking occurring at 25% of the credit received.

Follow my blog by email, RSS feed or Twitter (@DTRTrading). All options are available on the top of the right hand navigation column under the headings "Subscribe To RSS Feed", "Follow By Email", and "Twitter".

No comments:

Post a Comment